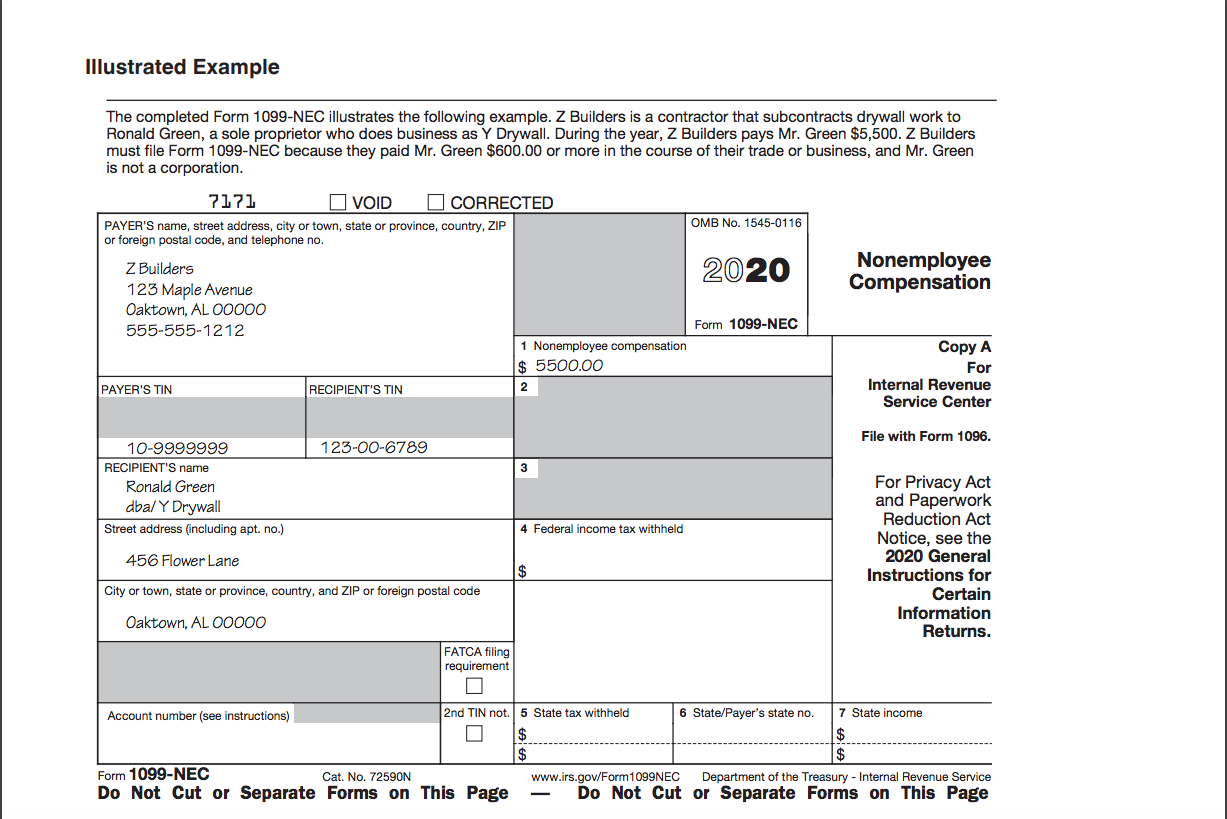

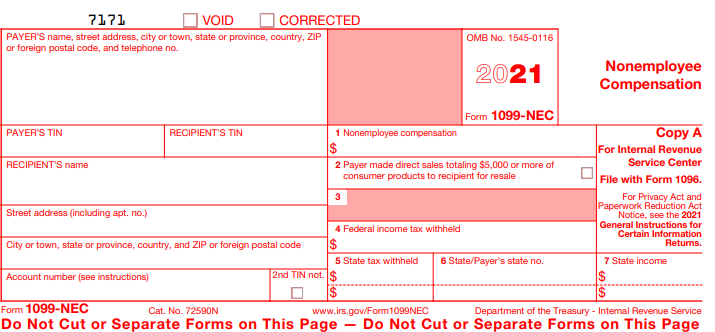

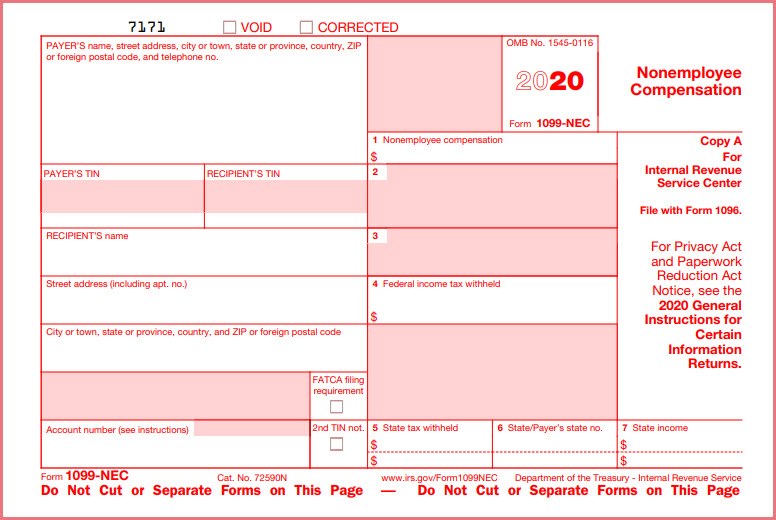

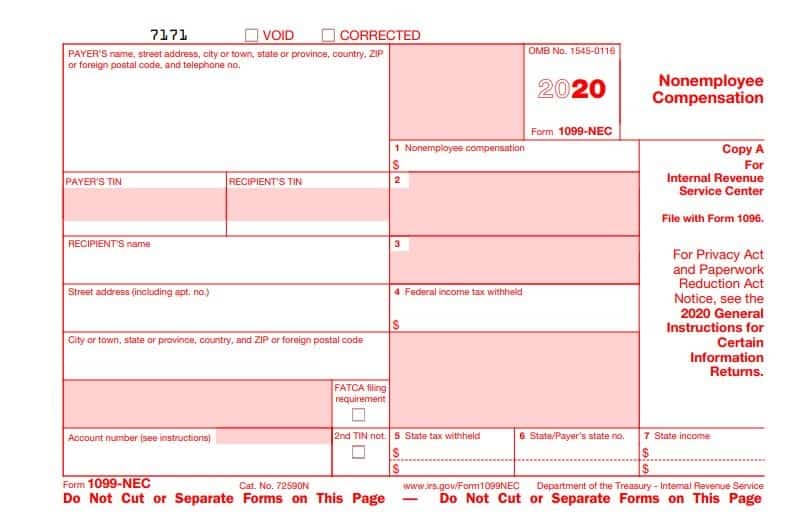

Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeForm 1099NEC Nonemployee Compensation Since you were not an employee of the company or person who paid you, your payment (compensation) is reported on the 1099NEC instead of Form W2 Per IRS Instructions for Forms 1099MISC and 1099NEC Miscellaneous Information and Nonemployee Compensation, on page 10Feb 05, 21 · This article will help you enter income and withholding from Form 1099NEC in Lacerte Starting in tax year , nonemployee compensation may be reported to your client on Form 1099NEC In previous years, this type of income was typically reported on Form 1099MISC, box 7 Where do I enter box 1,

Use Form 1099 Nec To Report Non Employee Compensation In

1099 nonemployee compensation tax rate

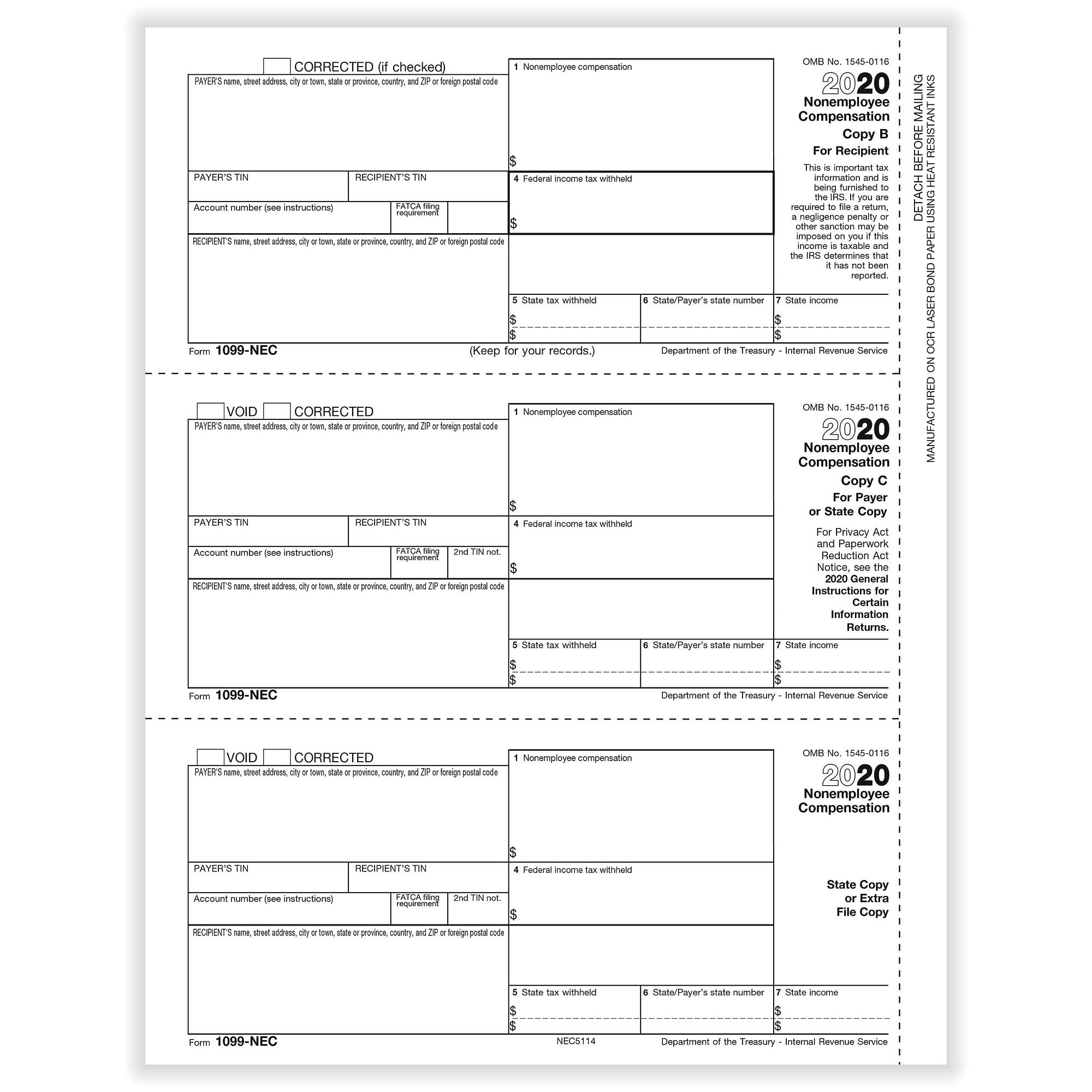

1099 nonemployee compensation tax rate-Jul 06, · There is a new Form 1099NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation Starting in tax year , payers must complete this form to report any payment of $600 or more to a payee Generally, payers must file Form 1099NEC by January 31Form 1099NEC Nonemployee Compensation Worksheet Double click to link to Schedule C I have no idea what this is or how to move past the issue What does it want?

Form 1099 Nec What Does It Mean For Your Business

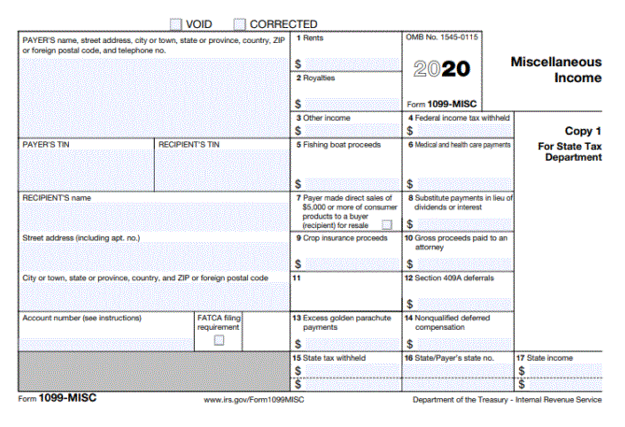

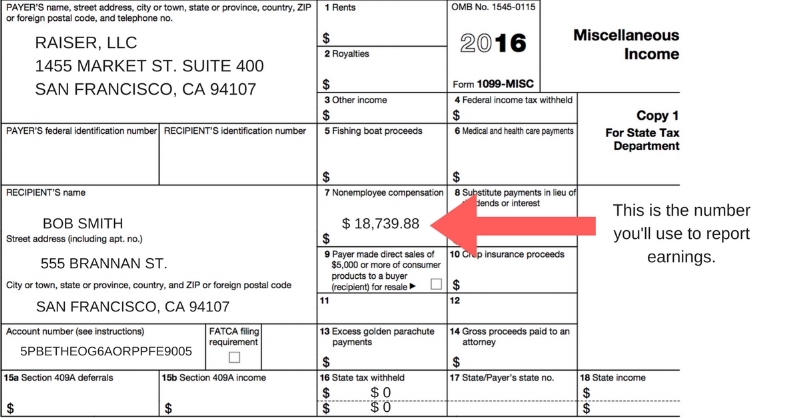

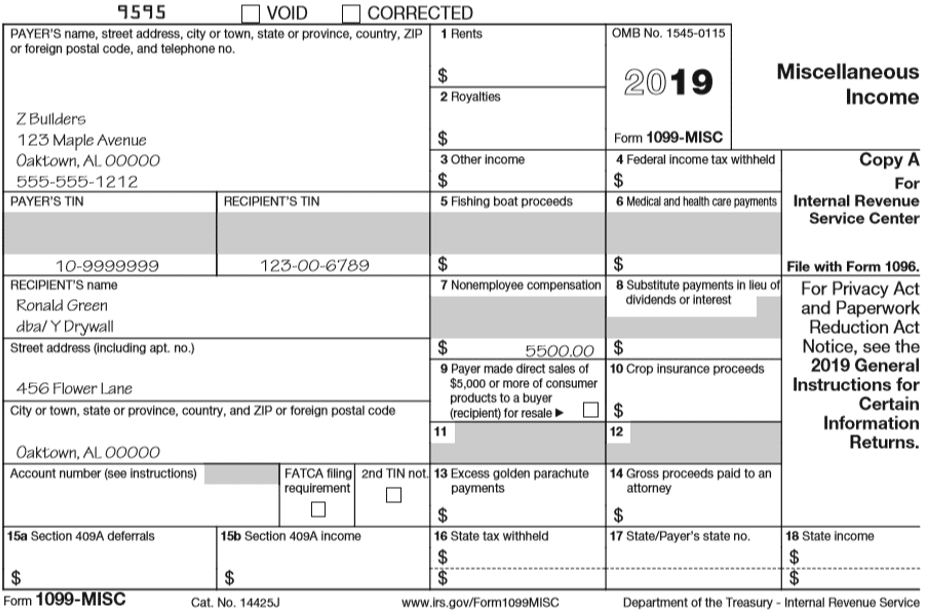

Feb 02, 12 · On the 1099misc, line 3 "other income" is not connected to any other tax form that can be used to write off business expenses, but line 7 "nonemployee compensation" is When the tax preparer inputs the data from your 1099misc, it must be an exact match as the formDec 21, · The PATH Act changed the Form 1099MISC due date to January 31 for reporting nonemployee compensation to the IRS The due date to the recipient remained January 31 Because of the due date change for filing the nonemployee compensation with the IRS, taxpayers had to separate nonemployee compensation using two Form 1099sNonemployee Compensation on 1099 NEC Form For more details regarding IRS Form 1099 NEC, contact our customer care number on 1 (316) To File your IRS 1099 Form NEC, visit our website at wwwefile1099misccom We are offering 24 hours helpline services for the clients So, you contact our support at any time to solve your issues

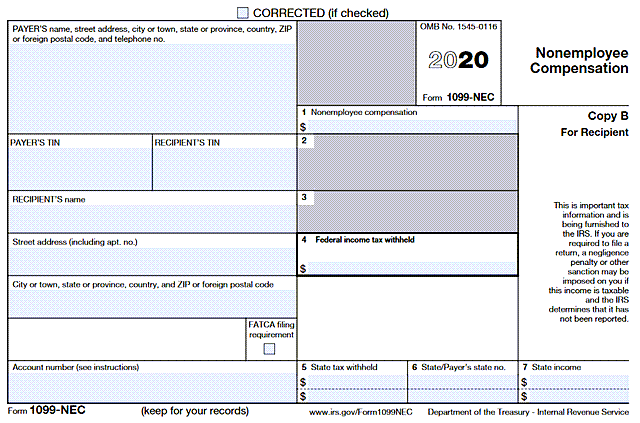

Sep 09, 19 · If you're not sure what payment types you might have made to contractors this year, review the IRS's instructions for Forms 1099MISC and 1099NEC, or consult your accountant 1099NEC Nonemployee compensation (Box 1) Most businesses will choose this box Enter nonemployee compensation (NEC) of $600 or moreSep 23, · The renewed 1099NEC form separates out nonemployee compensation from other sections of the 1099MISC and imposes a filing deadline of Feb 1, 21 To be clear, you may still need to use both formsForm 1099NEC, Nonemployee Compensation Form 1099NEC is used by payers to report payments of $600 or more made in the course of a trade or business to others for services Prior to , these payments were reported in box 7 on Form 1099MISC

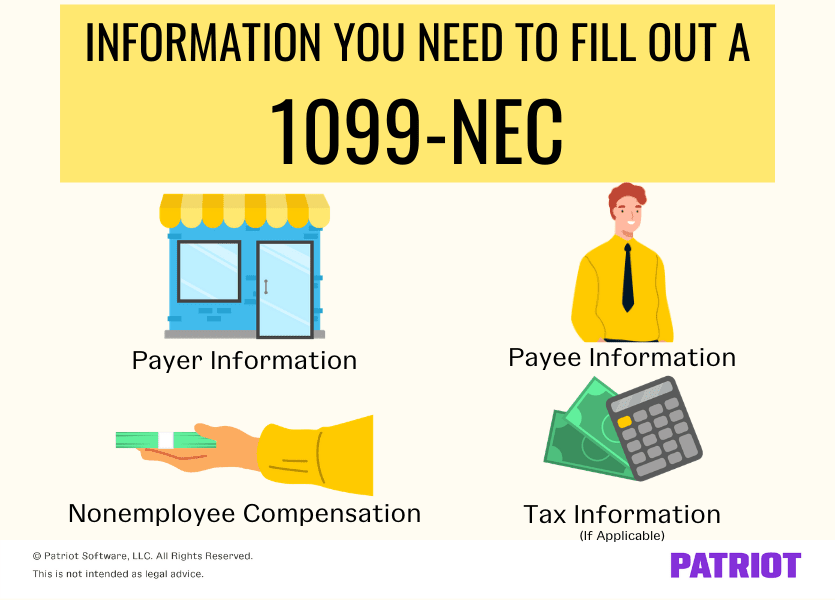

Dec 03, · If you pay an independent contractor nonemployee compensation, separate nonemployee compensation payments from all of your other Form 1099MISC payments You must know how to fill out a 1099NEC if you have any workers you paid $600 or more to in nonemployee compensationJan 19, 21 · Form 1099NEC, Nonemployee Compensation, is a form business owners use to report nonemployee compensation Only use this form to report nonemployee compensation to independent contractors Do not report other types of payments Form 1099NEC did not replace Form 1099MISC It just took over the nonemployee compensation portion of 1099MISCMar 18, 21 · If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC You may simply perform services as a nonemployee

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

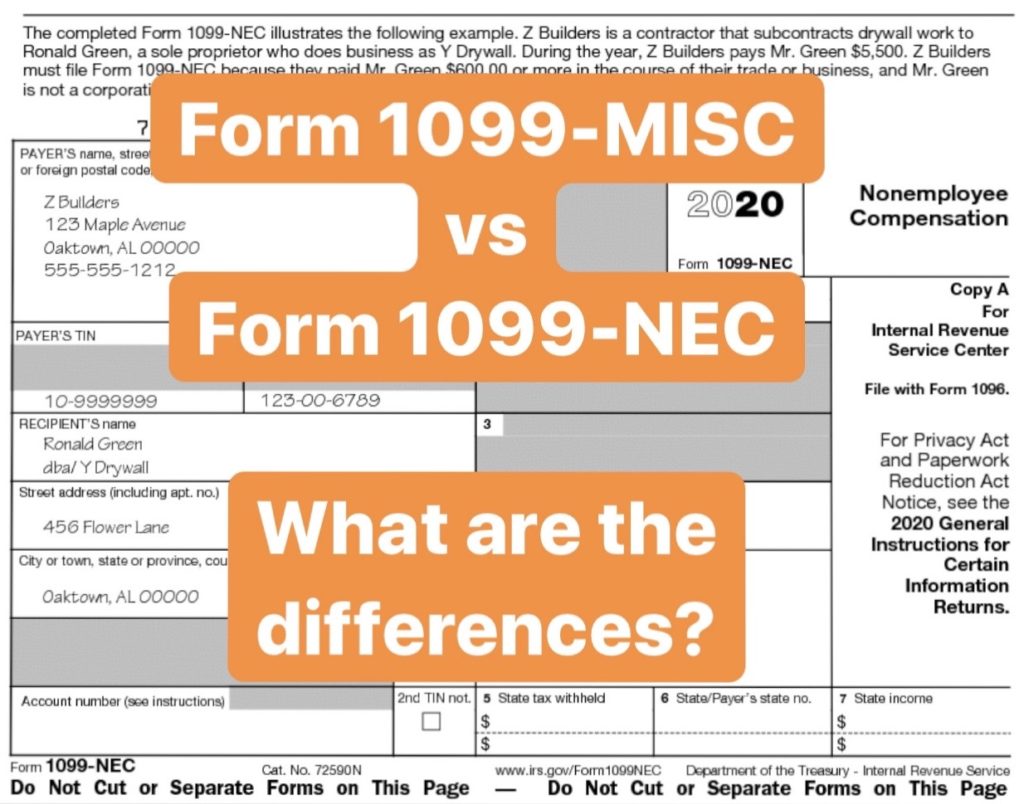

Nov 18, · Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in Box 1 on the 1099NEC It should be noted that Form 1099NEC was previously used by the IRS until 19 when the IRS added box 7 to Form 1099MISC and discontinued the 1099NEC formJan 08, 21 · Because the IRS removed reporting for nonemployee compensation from Form 1099MISC for tax year and onward, the IRS redesigned that form as well The biggest adjustment comes to Box 7, whichDec 15, · Effective with tax year , nonemployee compensation will be reported on Form 1099NEC, Nonemployee Compensation, instead of reporting in box 7 of Form 1099MISC The filing deadline for Form 1099NEC is January 31 to both the recipient and the IRS

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

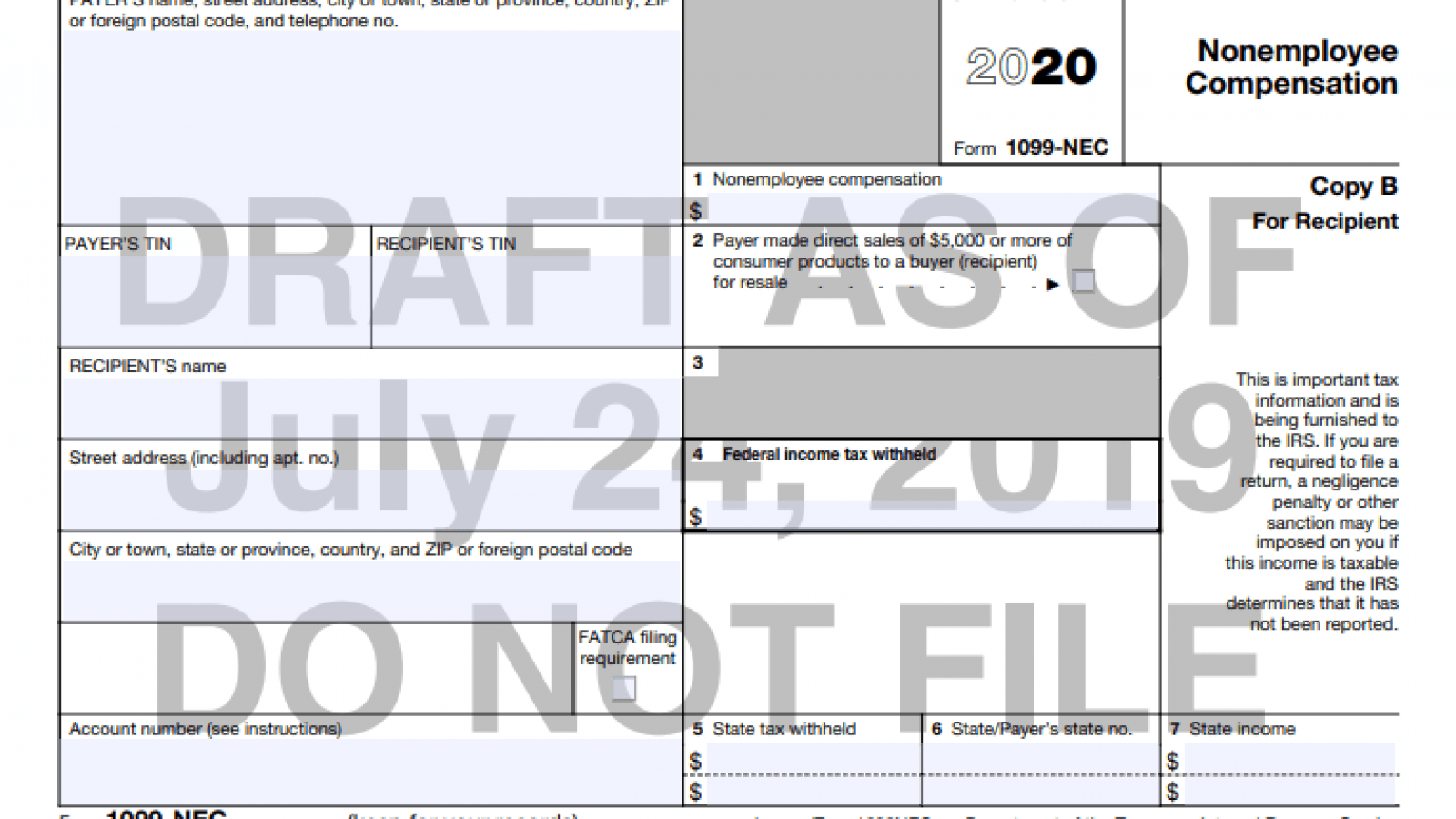

Irs To Reinstate Form 1099 Nec Requests Comments On Draft

Jan 27, 21 · Lastly, while nonemployee compensation has been removed from the 1099Misc, the form still exists File a Form 1099MISC , Miscellaneous Income for each person your business has paid at leastFeb 15, · Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISC Subsequently, box 7 on form 1099MISC for tax year has been removed Actually, this new form was an old form that has not been in use since 19 Because there were separate filling dates for box 7 on the 1099MISC and the other types of1 Tax Notes New IRS Form 1099NEC, Nonemployee Compensation, for Payments By John Brant, Tax Manager and Krista Picone, Tax Supervisor The IRS has recently released a draft of a new form, Form 1099NEC, which will be used to report

How To Read Your 1099 Misc

Form 1099 Nec Instructions And Tax Reporting Guide

IRS Publication 1 A document published by the Internal Revenue Service that identifies a taxpayer's rights and outlines the processes followed by the IRS when it examines a taxpayer, issues aFeb 04, 21 · The nonemployee compensation reported in Box 1 of Form 1099NEC is generally reported as selfemployment income and likely subject selfemployment tax Payments to individuals that are not reportable on the 1099NEC form, would typically be reported on Form 1099Nov 23, · The IRS has rolled out a new form for payers to use when reporting nonemployee compensation, separating it from the historical use of Form 1099MISC Nonemployee compensation for years has been reportable on line 7 of Form 1099MISC, but beginning with forms, filers instead will report nonemployee compensation on Form 1099NEC

1099 Nec And 1099 Misc Changes And Requirements For Property Management

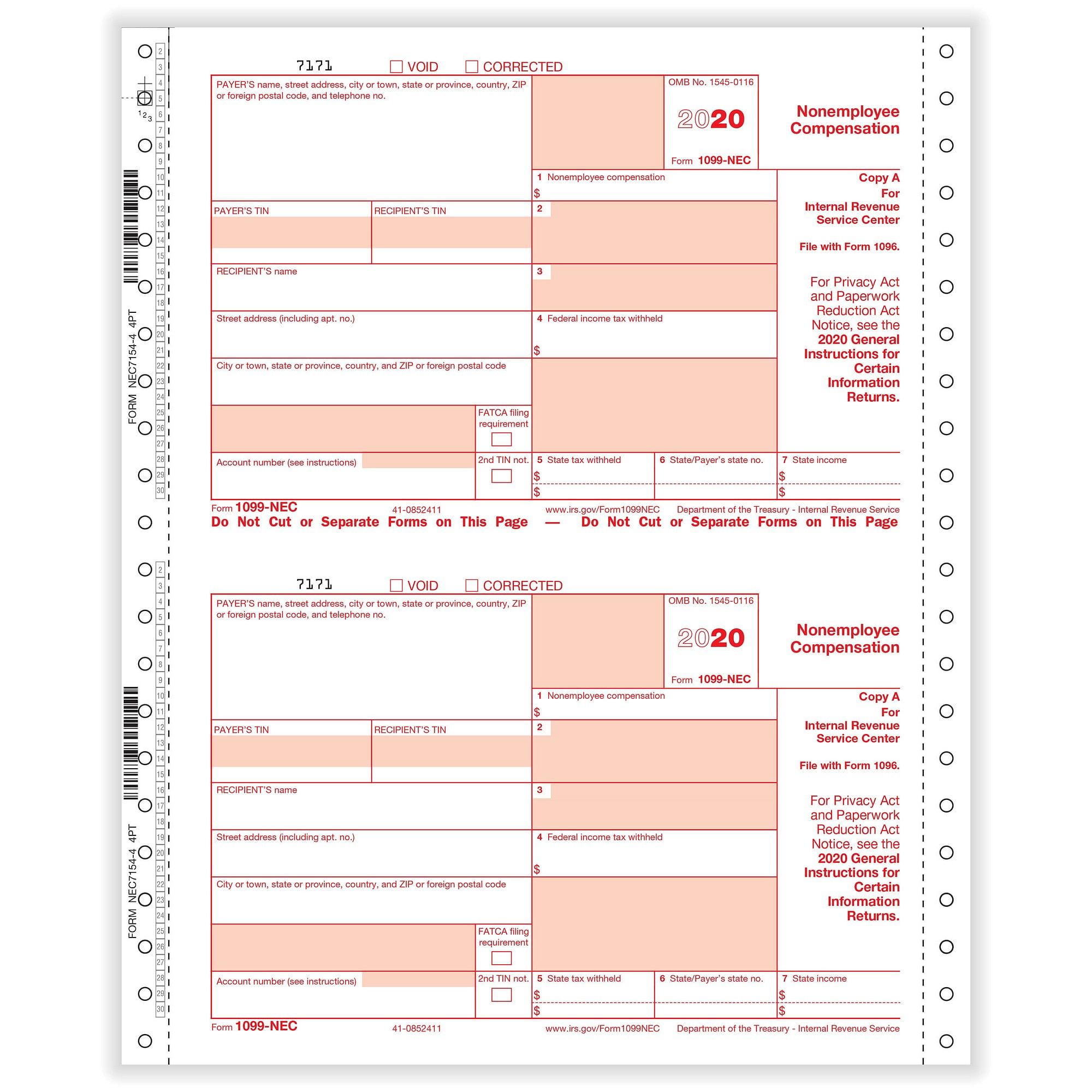

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Beginning with the tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099NEC instead of on Form 1099MISC Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor If you are selfemployed,Jun 05, 19 · Ordinarily 1099MISC box 7 nonemployee compensation is considered selfemployment income and entered on a schedule C However, the 1099MISC form instructions say 'If you are not an employee but the amount in this box is not SE income (for example, it is income from a sporadic activity or a hobby), report it on Form 1040, line 21Dec 16, 14 · If you receive a Form 1099 from your employer at the end of the year, instead of a W2, the money that you were paid is considered nonemployee compensation It's important to know the difference, in part because of the tax consequences that come with being labeled a "nonemployee" source IRS

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

1099 Nec A New Way To Report Non Employee Compensation Hlb Gross Collins

May 19, 17 · If you paid an independent contractor $600 or more, you need to file Form 1099NEC, Nonemployee Compensation In order to fill out Form 1099NEC, the independent contractor needs to complete Form W9 , Request for Taxpayer Identification Number and Certification, when they begin work for youNov 26, · The form 1099MISC was mainly for reporting miscellaneous income and Nonemployee compensation by February 28th every year The PATH Act was made known in 15 This act changed the due dates of form 1099MISC to January 31st for filing nonemployee compensationIncome reported on Form 1099NEC must be included on Schedule C

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

What Is Form 1099 Nec

Statement of NonEmployee Compensation 1099SF_19_V2 Form 1099SF If $000 compensation was earned in Louisville Metro, do not enter a record for the recipient Column 1 Column 2 Column 3 Column 4 Column 5 Recipient's Name Recipient's Address Recipient'sSep , 17 · Nonemployee compensation is reported on Form 1099MISC Nonemployee compensation (also known as selfemployment income) is the income you receive from a payer who classifies you as an independent contractor rather than as an employee This type of income is reported on Form 1099MISC, and you're required to pay selfemployment taxes on itMay 07, 21 · What is Form 1099NEC Nonemployee Compensation?

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeBeginning in the tax year, Form 1099NEC is the Internal Revenue Service (IRS)form used by businesses to report payments made to independentDec 18, · For reference, the IRS defines nonemployee compensation in the Instructions for Forms 1099MISC and 1099NEC () as the following If a payment meets these four conditions, it should generally be reported on the1099NEC You made the payment to

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Dec 29, · Way back in 15, the Protecting Americans from Tax Hikes (PATH) Act of 15 accelerated the due date for filing any Form 1099 that includes nonemployee compensation (NEC) from February 28 to January 31 and eliminated the automatic 30day extension for forms that include NECRather than having different Form 1099MISC due dates depending on whetherNov 17, 18 · Nonemployee compensation is reported on Form 1099MISC and represents any earnings paid to you by a company when you are not acting in the capacity of an employee Payments under $600 in a given tax year are not required to be reported by the payer, so he may not file a 1099MISC for youUntil 15, the deadline to file 1099 MISC with nonemployee compensation and other miscellaneous payments was February 28 In 15, the introduction of the Protecting Americans from Tax Hikes Act changed the deadline to January 31 for filing 1099MISC with non employee compensation specifically Prior to

1099 Nec Non Employee Compensation 4 Part 1 Wide Carbonless 0 Forms Pack

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

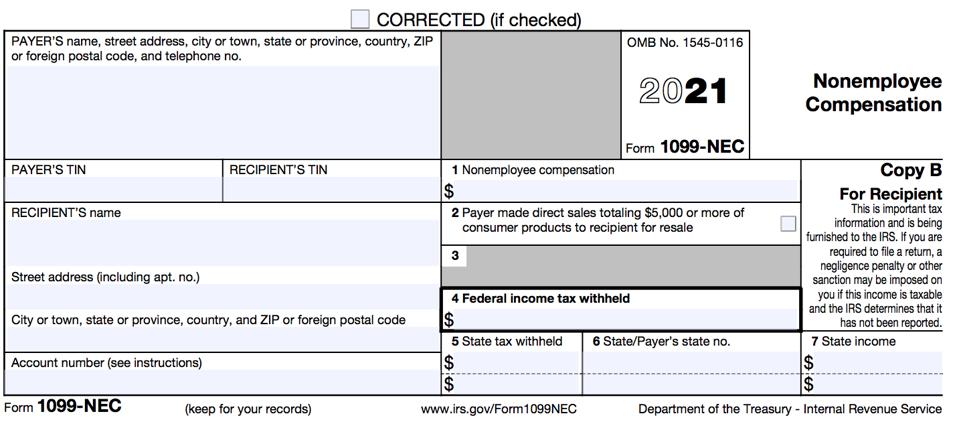

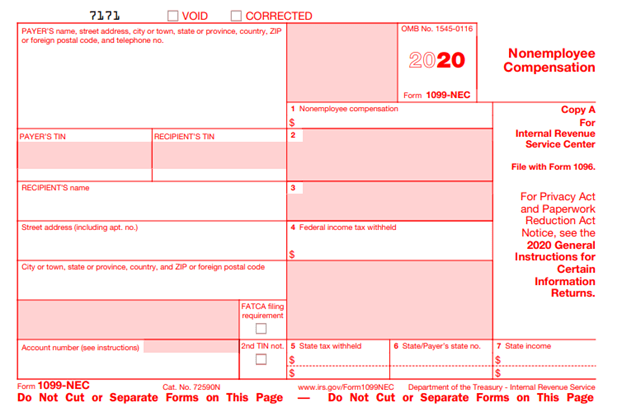

Nonemployee compensation $ 2 3 4 Federal income tax withheld $ 5 State tax withheld $ $ 6 State/Payer's state no 7 State income $ $ Form 1099NEC wwwirsgov/Form1099NEC Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This PageJan 25, 21 · New Form 1099NEC The IRS has made big changes to the 1099MISC form by reviving the 1099NEC form Beginning with the tax year (to be filed by February 1, 21) the new 1099NEC form will be used for reporting nonemployee compensation (NEC) payments Previously NEC was reported in Box 7 of the 1099MISC formFeb 22, 21 · About Form 1099NEC, Nonemployee Compensation Use Form 1099NEC to report nonemployee compensation

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

1099 Nec Withholding Tax Return For Nonemployee Compensation

Nov 25, · IRS Form 1099NEC is filed by payers who have paid $600 or more as nonemployee compensation for an independent contractor or vendor (ie, nonemployee) in a calendar year The form must be filed with the IRS and also a copy of the return must be furnished to the recipient 2 Who must file Form 1099NEC?

1099 Nec Nonemployee Compensation Recipient State Copy 2 2up

Reporting Non Employee Compensation A Year Of Change Best Best Krieger

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Memo For 1099 Nec Replaces 1099 Misc For Nec Non Employee Compensation Chris Whalen Cpa

Is Your Business Prepared For Form 1099 Changes Rkl Llp

Self Employed Vita Resources For Volunteers

Form 1099 Nec What Does It Mean For Your Business

You Can T Trust Your 1099s Endovascular Today

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Wade Howard Associates Cpas Llp

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What S The New 1099 Nec For Non Employee Compensation

Irs 1099 Misc Vs 1099 Nec Inform Decisions

What Is A 1099 Misc Personal Finance For Phds

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Use Form 1099 Nec To Report Non Employee Compensation In

Form 1099 Nec Nonemployee Compensation 1099nec

New Form 1099 Nec Non Employee Compensation Virginia Cpa

Form 1099 Nec Reporting Nonemployee Compensation Albin Randall And Bennett

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Misc Form Copy C 2 Payer State Discount Tax Forms

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Form 1099 Nec Nonemployee Compensation Definition

New Form 1099 Nec Replaces 1099 Misc For Reporting Non Employee Compensation For Boyer Ritter Llc

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

1099 Misc Form Copy B Recipient Discount Tax Forms

Nonemployee Compensation Form 1099 Due Dates Wichita Cpa Firm

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

Irs Form 1099 Nec Non Employee Compensation

Introducing The New 1099 Nec For Reporting Nonemployee Compensation Asap Accounting Payroll

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

1099 Nec Non Employee Compensation Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

Form 1099 Nec Nonemployee Compensation Definition

1099 Nec A New Way To Report Non Employee Compensation

Irs Tax Form 1099 Nec What It Is And What You Need To Know To Use It Blog For Accounting Quickbooks Tips Peak Advisers Denver

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Nec Nonemployee Compensation 5 Part Packaged Set

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

The New 1099 Nec Tax Form For All Non Employee Compensation

What Is Form 1099 Nec Who Uses It What To Include More

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Ready For The 1099 Nec

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Irs Update New Form 1099 Nec Alfano Company Llc

Irs Launches New Form Replacing 1099 Misc For Contractors In Cpa Practice Advisor

1099 Nec Available Page 4

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Nec Withholding Tax Return For Nonemployee Compensation Sap Blogs

New Irs Form 1099 Nec For Nonemployee Compensation Vero Beach Fl Accountant Kega Cpas

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Changes In 1099 Reporting For Tax Year Form 1099 Nec

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Form 1099 Nec For Nonemployee Compensation H R Block

Preparing For The New Form 1099 Nec Nonemployee Compensation Bmf

1099 Nec 1099 Express

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

1099 Nec Nonemployee Compensation Rightway Tax Solutions

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

New Irs Rules For Reporting Non Employee Compensation With Form 1099 Nec Complyright

Form 1099 Nec Nonemployee Compensation 1099nec

1099 Nec Form Copy B Recipient Zbp Forms

What S The Irs Form 1099 Nec Atlantic Payroll Partners

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

1099 Nec Form Copy B C 2 3up Discount Tax Forms

Tax Updates Form 1099 Atlanta Tax Cpas

What Is Form 1099 Nec For Nonemployee Compensation

How To Add 1099 Nec To Your Sage 100 Tax Forms

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

1099 Nec Withholding Tax Return For Nonemployee Compensation Sap Blogs

How To Use The New 1099 Nec Form For Dynamic Tech Services

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

0 件のコメント:

コメントを投稿